Nota Features

Take Control of Your Accounts

annotation, real-time reconciliation, and financial services with concierge support

Nota Features

annotation, real-time reconciliation, and financial services with concierge support

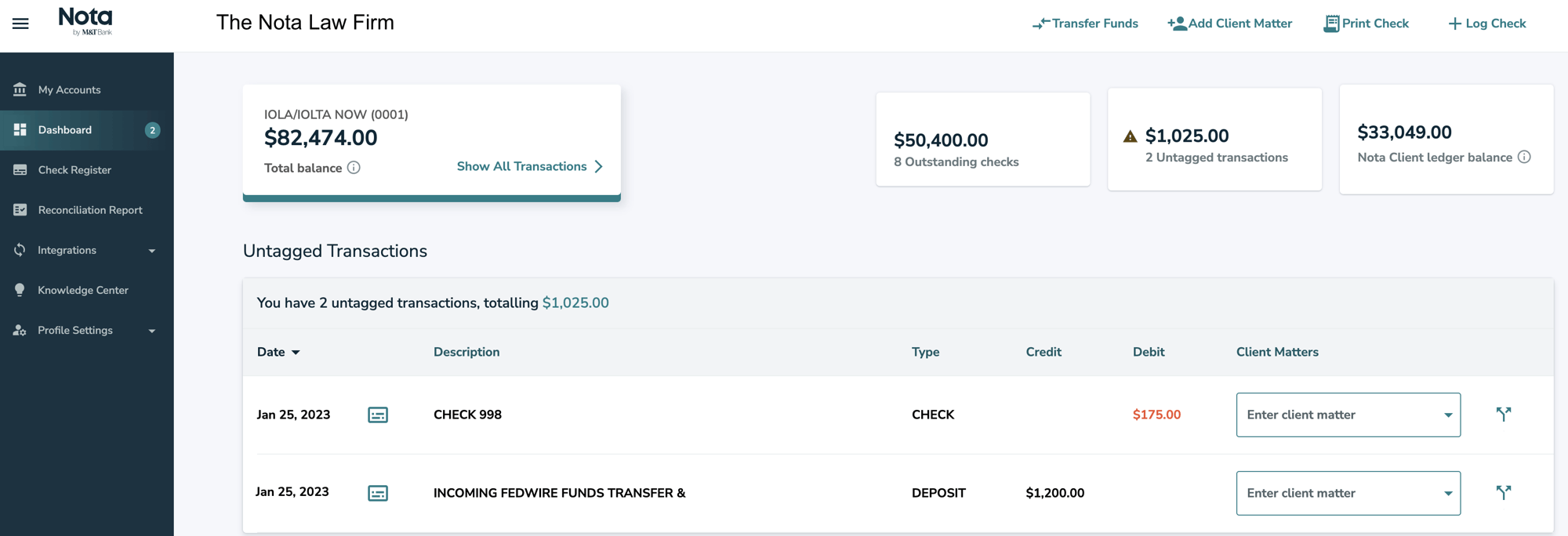

Client Trust Accounts

Nota allows you to take control of your IOLTA/IOTA trust accounts with bank-verified tools and reporting.

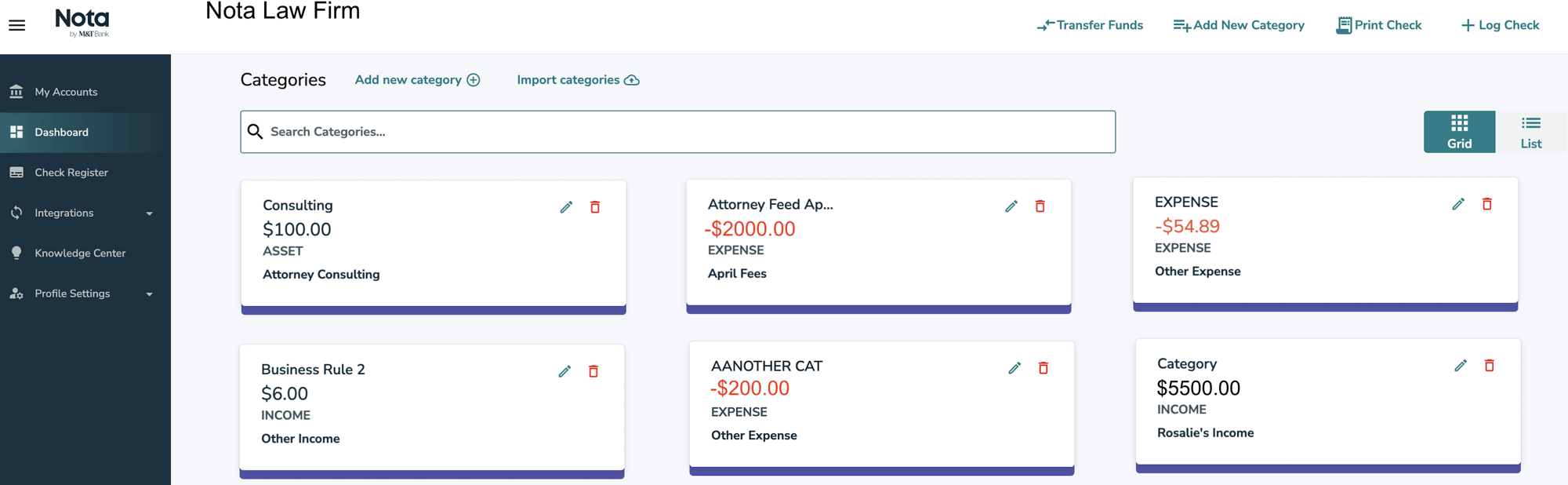

Operating Accounts

We understand the unique needs of attorneys and have created solutions that streamline your business banking.

Business Credit Card

(NOW LIVE)

Get a complete look at your firm’s business banking. Nota allows you to review and organize your Business Credit Card account.

.png?width=1790&height=596&name=BCC%20(3).png)

Business Lines of Credit

Prepare for the unexpected with funds you can access anytime.

Term Loans

Finance capital and large purchases, real estate renovations and more with our flexible, accessible term loans.

Bank Reconciled

Minimize financial risk with real-time, bank-verified reconciliation of your accounts

.png?width=60&height=60&name=Direct%20Annotations%20(1).png)

Direct Annotations

Annotate and separate transactions directly against the bank ledger

Track by Client

One-click access to all transactions by client for complete analysis and reporting

Custom Alerts

Set alerts for account changes you don’t want to miss, like a check clearing funds or a balance threshold reached

Print Checks

Print checks on your accounts directly from the Nota dashboard, and have it logged automatically

Wire Funds

Send wires from Nota, with compliant electronic record-keeping at no charge.

Built for Attorneys

Nota experts and Dedicated Specialists are Committed to your Practice’s Success.

Concierge Customer Support

Nota customers benefit from a single point of contact, trained in the unique needs of legal banking, to provide support and answer any questions you have.

Business Credit Cards

Let your dedicated specialist help guide you to the right credit card for your firm, all with minimal hassle.

Grow Your Firm With A Loan

Because we understand your unique needs, your Nota specialist will help secure a competitive loan with M&T Bank to grow your law practice.

Banking with M&T Bank

Committed to independent businesses, M&T Bank products and services are designed for businesses like yours.

Optimize your Workflows and Efficiency without switching between platforms.

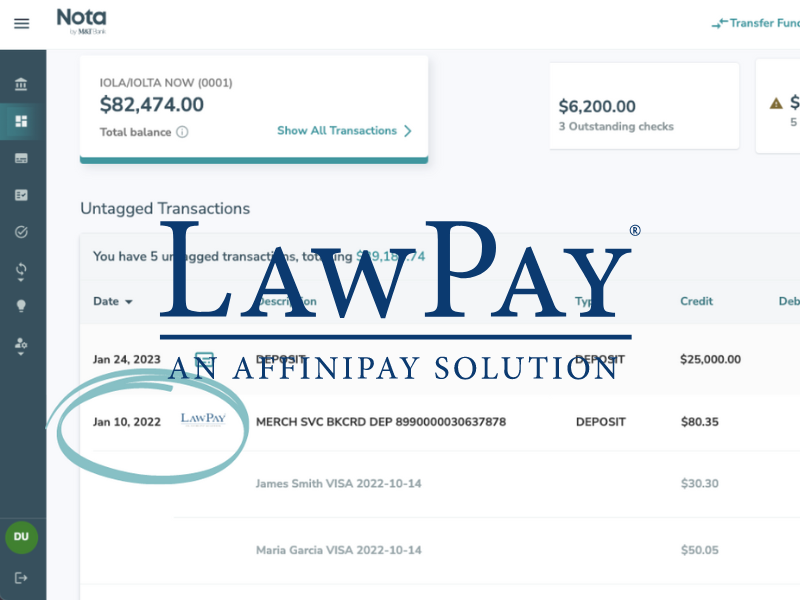

A payment partner

LawPay makes it easy to maintain trust account (IOLTA/IOLA) compliance

Integration

Nota Users see detailed LawPay client payment information right in their online trust account

Benefits

Access to partner-specific promotions: $60 Savings, Nota will waive your Monthly LawPay fee for 3 Months!

CLEs

Access to 1000+ Lawline CLE Courses

Webinars

Access to Live Webinars

Benefits

1 Year Unlimited Access: $299 Savings, Nota users receive unlimited free access

1-800-724-1313

One M&T Plaza Buffalo, NY 14203